Unlocking The Power Of PPP Loan California: Your Ultimate Guide To Financial Relief

PPP Loan California has become a lifeline for countless small businesses across the Golden State. With the economic challenges faced over the past few years, accessing financial assistance has never been more crucial. Whether you're a seasoned entrepreneur or just starting out, understanding how PPP loans work can make all the difference in keeping your business afloat. So, let's dive in and explore everything you need to know about these loans and how they can benefit your business.

Imagine this: you're running a small café in downtown LA, and suddenly everything comes to a grinding halt due to unforeseen circumstances. That's where PPP Loan California steps in to save the day. This program is specifically designed to help small businesses like yours by providing much-needed financial relief. It's not just about surviving; it's about thriving in tough times.

Now, you might be wondering, "Is this program really worth it?" The answer is a resounding yes. PPP loans have been instrumental in helping businesses across California navigate through turbulent waters. From covering payroll expenses to keeping employees on board, the benefits are vast and varied. Let's break it down further and see how you can take advantage of this opportunity.

- Movierulz Kostenlose Filme Die Wahrheit Ber Movierulz Alternativen

- Sdindisches Kinohighlight Kalki 2898 Ad Filmyflyalternativen 2025

What Exactly is PPP Loan California?

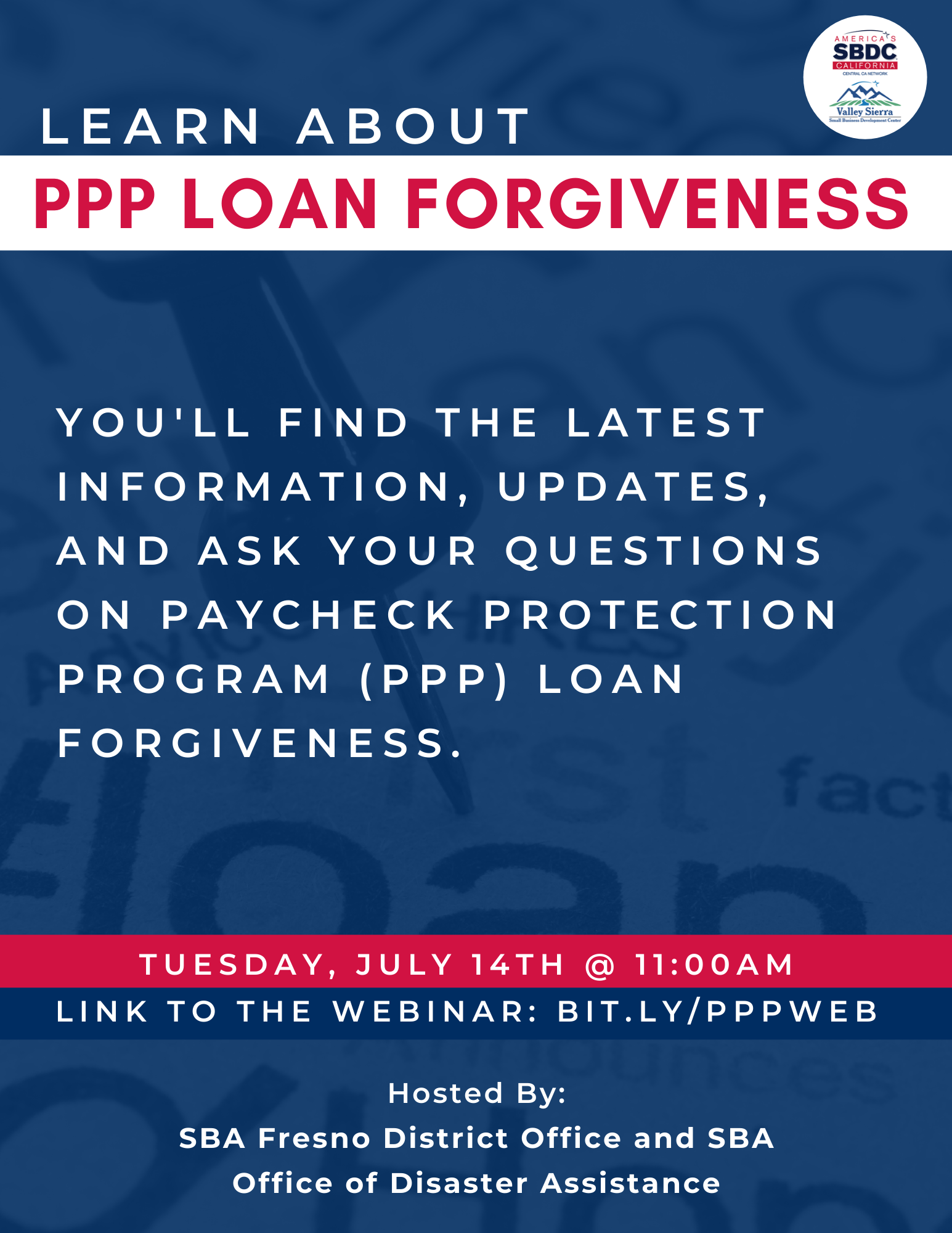

PPP Loan California, or the Paycheck Protection Program, is a government initiative aimed at supporting small businesses affected by economic downturns. It offers forgivable loans to help cover payroll and other essential expenses. This program was first introduced as part of the CARES Act back in 2020 and has since been updated to meet the evolving needs of businesses.

Here's the kicker: if you use the funds for eligible expenses, such as payroll, rent, utilities, and mortgage interest, the loan can be fully forgiven. That's right, folks – it's essentially free money to keep your business running smoothly.

Eligibility Criteria for PPP Loans

Not everyone can jump on board with PPP Loan California, but don't worry – the eligibility criteria are pretty straightforward. First off, your business needs to have 500 or fewer employees. This includes sole proprietors, independent contractors, and self-employed individuals. Additionally, you must demonstrate that your business has been impacted by the economic challenges faced in recent years.

- Vegane Filme Entdecke Filme Mit Starker Botschaft Vegmovies

- Suche Ohne Ergebnis Ullu Originals Mehr Tipps Tricks

- Businesses with 500 or fewer employees

- Sole proprietors, independent contractors, and self-employed individuals

- Proof of economic impact on your business

How to Apply for PPP Loan California?

Applying for PPP Loan California is a relatively simple process, but it does require some preparation. First things first, gather all the necessary documents. This includes your tax forms, payroll records, and proof of business ownership. Once you have everything in order, you can apply through participating lenders, which include banks, credit unions, and other financial institutions.

It's worth noting that the application process has been streamlined to make it more accessible for small business owners. Many lenders now offer online applications, which can save you a ton of time and hassle.

Documentation You'll Need

When applying for a PPP loan, having the right documentation is key. Here's a quick rundown of what you'll need:

- Tax forms (e.g., Form 1040 Schedule C for sole proprietors)

- Payroll records, including employee information and payment history

- Proof of business ownership, such as articles of incorporation or partnership agreements

- Bank statements and financial statements

Benefits of PPP Loan California

Let's talk about the perks of PPP Loan California. One of the biggest advantages is the potential for loan forgiveness. If you use the funds for eligible expenses, you won't have to pay the money back. This can be a game-changer for businesses struggling to make ends meet.

Another benefit is the low interest rate. PPP loans come with an interest rate of just 1%, making them much more affordable than traditional business loans. Plus, there are no prepayment penalties, so you can pay off the loan early without any extra fees.

How PPP Loans Can Boost Your Business

PPP Loan California isn't just about survival; it's about growth. By securing this financial assistance, you can focus on expanding your business, hiring more employees, and investing in new opportunities. Here are a few ways PPP loans can help:

- Stabilize cash flow

- Retain and hire employees

- Invest in marketing and advertising

- Upgrade equipment and technology

Common Misconceptions About PPP Loan California

There are a few myths floating around about PPP Loan California that need to be debunked. For starters, some people think that only large corporations can benefit from these loans. That's simply not true. PPP loans are specifically designed for small businesses, and there's plenty of funding available for those who qualify.

Another misconception is that the application process is overly complicated. While it does require some preparation, it's far from impossible. With the right guidance and documentation, you can easily navigate the application process and secure the funding you need.

Clearing Up the Confusion

Let's clear up some of the confusion surrounding PPP Loan California:

- PPP loans are available to small businesses, not just large corporations

- The application process is manageable with the right preparation

- Loan forgiveness is possible if funds are used for eligible expenses

Success Stories from PPP Loan California

There are countless success stories from businesses that have benefited from PPP Loan California. Take, for example, a small bakery in San Francisco that was struggling to stay afloat during tough times. Thanks to a PPP loan, the bakery was able to keep its employees on payroll and continue serving the community.

Another inspiring story comes from a tech startup in Silicon Valley. With the help of a PPP loan, the startup was able to expand its team and develop innovative new products. These stories highlight the transformative power of PPP loans and how they can make a real difference in the lives of business owners.

Real-Life Examples of PPP Loan Impact

Here are a few real-life examples of how PPP Loan California has made a difference:

- A local bookstore in Sacramento kept its doors open and hired new staff

- A fitness studio in Orange County invested in new equipment and expanded its offerings

- A landscaping company in San Diego was able to retain its workforce and take on new projects

Challenges and Considerations

While PPP Loan California offers numerous benefits, there are some challenges to consider. One of the main concerns is ensuring that the funds are used appropriately to qualify for loan forgiveness. It's essential to keep detailed records of how the money is spent and to consult with a financial advisor if needed.

Another consideration is the competition for funding. With so many businesses applying for PPP loans, it's important to submit your application early and make a strong case for why your business deserves the support.

Overcoming Potential Hurdles

Here are some tips for overcoming potential hurdles when applying for a PPP loan:

- Prepare all necessary documentation in advance

- Apply early to increase your chances of approval

- Consult with a financial advisor to ensure compliance

Future of PPP Loan California

As the economic landscape continues to evolve, the future of PPP Loan California remains uncertain. However, there are indications that the program may be extended or modified to meet the ongoing needs of small businesses. Keeping an eye on updates from the SBA and other government agencies is crucial for staying informed.

In the meantime, if you're eligible for a PPP loan, it's a good idea to apply sooner rather than later. Even if the program changes in the future, securing funding now can provide much-needed stability for your business.

Staying Informed About Program Updates

To stay informed about PPP Loan California updates, consider the following:

- Follow the Small Business Administration (SBA) website for the latest news

- Subscribe to newsletters from reputable financial institutions

- Engage with local business groups and chambers of commerce

Conclusion: Take Action Today!

In conclusion, PPP Loan California is a vital resource for small businesses looking to overcome economic challenges. By understanding the eligibility criteria, application process, and benefits, you can take full advantage of this program and set your business up for success.

So, what are you waiting for? Don't let fear or uncertainty hold you back. Take action today by gathering your documentation and submitting your application. And don't forget to share this article with fellow business owners who could benefit from this information. Together, we can build a brighter future for small businesses across California!

Table of Contents

- What Exactly is PPP Loan California?

- Eligibility Criteria for PPP Loans

- How to Apply for PPP Loan California?

- Benefits of PPP Loan California

- Common Misconceptions About PPP Loan California

- Success Stories from PPP Loan California

- Challenges and Considerations

- Future of PPP Loan California

- Conclusion: Take Action Today!

Detail Author:

- Name : Dejah Brown MD

- Username : mallory.kessler

- Email : effertz.alex@gmail.com

- Birthdate : 1990-04-19

- Address : 24769 Gutmann Landing Jessicaton, UT 17289-9961

- Phone : +1 (620) 376-9079

- Company : Bednar and Sons

- Job : Home

- Bio : Fuga reprehenderit accusamus porro vel. Sapiente sunt aliquid provident sit culpa. Rerum repellendus cupiditate omnis velit debitis aut maiores.

Socials

linkedin:

- url : https://linkedin.com/in/nicholas2138

- username : nicholas2138

- bio : Minus delectus magni ad eligendi sint mollitia.

- followers : 1109

- following : 857

instagram:

- url : https://instagram.com/carter2016

- username : carter2016

- bio : Quia doloremque sit sit rerum fugiat enim tempore iure. Dolor sit dolore sed beatae voluptas.

- followers : 4058

- following : 1314