Fidelity Retirement Accounts: Your Ultimate Guide To Secure Financial Future

When it comes to planning your retirement, having the right tools and strategies is crucial. Fidelity retirement accounts have become a go-to option for millions of people looking to secure their financial future. But what exactly are these accounts, and why should you consider them? Let's dive into the world of Fidelity and uncover everything you need to know about these powerful savings vehicles.

Retirement might seem like a distant dream when you're young, but trust me, time flies faster than you think. Building a solid foundation for your golden years requires smart decisions today. That's where Fidelity steps in with its robust retirement account options designed to help you grow your wealth over time. Whether you're just starting out or already have some savings, these accounts offer flexibility, expertise, and trustworthiness that align perfectly with your financial goals.

So, buckle up as we explore the ins and outs of Fidelity retirement accounts. From understanding the basics to maximizing your contributions, this guide will equip you with the knowledge you need to make informed decisions. Let's get started!

- Skandalvideo Vibhuti Khand Nachtclubermittlungen Was Wirklich Geschah

- Movierulz Kostenlose Filme Die Wahrheit Ber Movierulz Alternativen

Table of Contents

- What Are Fidelity Retirement Accounts?

- Benefits of Fidelity Retirement Accounts

- Types of Fidelity Retirement Accounts

- How to Open a Fidelity Retirement Account

- Investment Options in Fidelity Retirement Accounts

- Fidelity Retirement Account Fees

- Tax Considerations

- Common Mistakes to Avoid

- Tips for Maximizing Your Fidelity Retirement Account

- Frequently Asked Questions

What Are Fidelity Retirement Accounts?

Alright, let's break it down. Fidelity retirement accounts are investment vehicles offered by Fidelity Investments, one of the largest financial services firms in the world. These accounts are specifically designed to help individuals save and invest for their retirement. They come in different forms, each tailored to meet various financial needs and goals.

The beauty of Fidelity retirement accounts lies in their versatility. Whether you're self-employed, work for a company that offers a 401(k) plan, or simply want to set aside extra funds for your golden years, there's an option for you. Plus, Fidelity's reputation for expertise, authoritativeness, and trustworthiness makes them a reliable choice for long-term financial planning.

Why Choose Fidelity?

Here's the deal—Fidelity has been around since 1946, and over the years, they've built a solid reputation in the financial industry. Their commitment to customer service, innovative tools, and a wide range of investment options sets them apart from the competition. Plus, their user-friendly platform makes managing your retirement savings a breeze.

Benefits of Fidelity Retirement Accounts

Now, let's talk about the perks. There are plenty of reasons why Fidelity retirement accounts are worth considering. Here are some of the top benefits:

- Growth Potential: Fidelity offers a variety of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs), allowing your money to grow over time.

- Tax Advantages: Depending on the type of account you choose, you may enjoy tax-deferred growth or tax-free withdrawals in retirement.

- Professional Guidance: Fidelity provides access to financial advisors who can help you navigate complex retirement planning decisions.

- Low Fees: Many Fidelity retirement accounts come with low or no fees, helping you keep more of your hard-earned money.

These benefits make Fidelity retirement accounts an attractive option for anyone serious about securing their financial future.

Types of Fidelity Retirement Accounts

Not all retirement accounts are created equal. Fidelity offers several types of retirement accounts, each with its own unique features and benefits. Let's take a closer look at the most popular options:

Traditional IRA

A Traditional IRA is a tax-advantaged retirement account that allows you to make contributions with pre-tax dollars. This means your contributions may be tax-deductible, and your investments grow tax-deferred until withdrawal. However, keep in mind that withdrawals in retirement are subject to income tax.

Roth IRA

On the flip side, a Roth IRA is funded with after-tax dollars, so your contributions aren't tax-deductible. But here's the kicker—qualified withdrawals in retirement are tax-free. This makes Roth IRAs an excellent choice for those who expect to be in a higher tax bracket during retirement.

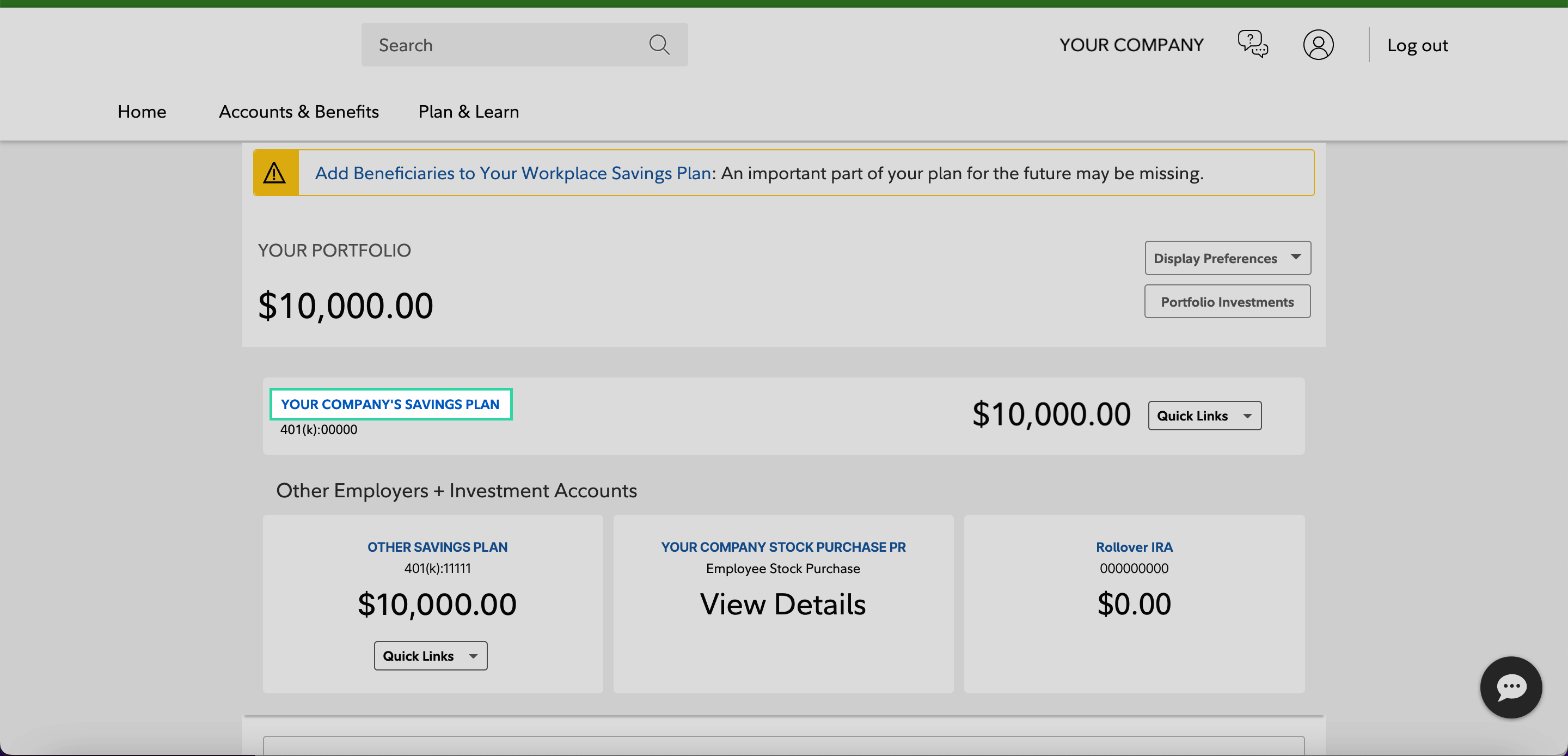

Rollover IRA

If you've left a job and have a 401(k) account, a Rollover IRA allows you to transfer those funds into a Fidelity retirement account without incurring taxes or penalties. It's a seamless way to consolidate your retirement savings.

Simplified Employee Pension (SEP) IRA

Self-employed individuals or small business owners can take advantage of a SEP IRA, which allows for higher contribution limits than traditional IRAs. This is a great option for those looking to maximize their retirement savings.

How to Open a Fidelity Retirement Account

Opening a Fidelity retirement account is a straightforward process. Here's a step-by-step guide to get you started:

- Visit the Fidelity website and click on "Open an Account."

- Select the type of retirement account you want to open (Traditional IRA, Roth IRA, etc.).

- Provide your personal information, including your Social Security number, employment details, and funding source.

- Choose your investment options based on your risk tolerance and financial goals.

- Fund your account by linking a bank account or transferring funds from an existing retirement account.

And just like that, you're on your way to building a secure financial future!

Investment Options in Fidelity Retirement Accounts

One of the coolest things about Fidelity retirement accounts is the wide range of investment options available. Whether you're a seasoned investor or just starting out, there's something for everyone:

- Mutual Funds: Diversified investment vehicles that pool money from multiple investors to purchase a portfolio of stocks, bonds, or other securities.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, but traded on an exchange like individual stocks, offering more flexibility and lower costs.

- Stocks: Ownership shares in publicly traded companies, offering potential for capital appreciation.

- Bonds: Fixed-income securities that provide regular interest payments and return of principal at maturity.

Fidelity also offers target-date funds, which automatically adjust your asset allocation as you approach retirement, making it easier to stay on track.

Fidelity Retirement Account Fees

Let's talk fees. While Fidelity is known for its low-cost offerings, it's important to understand the potential fees associated with your retirement account:

- Account Maintenance Fees: Many Fidelity retirement accounts have no account maintenance fees, but it's always a good idea to confirm.

- Transaction Fees: Depending on the type of investments you choose, you may incur transaction fees when buying or selling securities.

- Management Fees: Mutual funds and ETFs often have expense ratios, which are annual fees expressed as a percentage of your investment.

Keep in mind that Fidelity offers a variety of no-transaction-fee mutual funds and commission-free ETFs, helping you keep costs to a minimum.

Tax Considerations

Taxes can significantly impact your retirement savings, so it's essential to understand how they work with Fidelity retirement accounts:

- Traditional IRA: Contributions may be tax-deductible, but withdrawals in retirement are subject to income tax.

- Roth IRA: Contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free.

- Required Minimum Distributions (RMDs): Once you reach age 72, you're required to take minimum distributions from your retirement accounts, except Roth IRAs.

Consulting with a tax professional can help you navigate these complexities and optimize your retirement savings strategy.

Common Mistakes to Avoid

While Fidelity retirement accounts offer incredible opportunities, there are a few pitfalls to watch out for:

- Not Starting Early: Time is your greatest ally when it comes to retirement savings. The sooner you start, the more time your money has to grow.

- Underestimating Retirement Costs: Many people underestimate how much money they'll need in retirement. Aim for at least 80% of your pre-retirement income.

- Ignoring Diversification: Putting all your eggs in one basket can be risky. Diversify your investments to reduce exposure to market volatility.

- Withdrawing Early: Withdrawing funds from your retirement account before age 59½ may result in penalties and taxes, so it's best to leave your money alone until retirement.

Avoiding these mistakes can help you stay on track and achieve your financial goals.

Tips for Maximizing Your Fidelity Retirement Account

Ready to take your retirement savings to the next level? Here are some tips to help you make the most of your Fidelity retirement account:

- Contribute Regularly: Set up automatic contributions to ensure consistent savings over time.

- Take Advantage of Employer Matches: If your employer offers a 401(k) match, contribute enough to maximize this free money.

- Rebalance Your Portfolio: Periodically review and adjust your investments to align with your changing financial goals.

- Stay Informed: Keep up with market trends and economic news to make informed investment decisions.

Implementing these strategies can help you build a robust retirement nest egg.

Frequently Asked Questions

Got questions? We've got answers. Here are some of the most common questions about Fidelity retirement accounts:

Can I Roll Over My 401(k) to a Fidelity Retirement Account?

Absolutely! Rolling over your 401(k) to a Fidelity retirement account is a seamless process that allows you to consolidate your retirement savings and access a wider range of investment options.

What Happens to My Retirement Account if I Pass Away?

Upon your passing, your retirement account will be transferred to your designated beneficiaries. It's crucial to keep your beneficiary designations up to date to ensure your wishes are carried out.

Can I Withdraw Money from My Fidelity Retirement Account Before Retirement?

While it's possible to withdraw funds early, doing so may result in penalties and taxes. It's generally best to leave your retirement savings untouched until retirement.

How Much Should I Contribute to My Retirement Account?

Aim to contribute at least 15% of your annual income to your retirement account. If that's not feasible, start with what you can and gradually increase your contributions over time.

Conclusion

In summary, Fidelity retirement accounts provide a powerful tool for securing your financial future. With their wide range of investment options, tax advantages, and low fees, they're an excellent choice for anyone serious about retirement planning. By starting early, contributing regularly, and avoiding common mistakes, you can build a robust retirement nest egg that will support you for years to come.

So

Detail Author:

- Name : Annie Sauer

- Username : rosario.barton

- Email : ioconner@hotmail.com

- Birthdate : 1972-03-08

- Address : 89581 Boehm Freeway North Justusfurt, CA 98302

- Phone : +1 (908) 508-9570

- Company : McCullough and Sons

- Job : Drafter

- Bio : Omnis quis reprehenderit ipsum numquam. A porro et quo similique nihil eum et similique. Quibusdam qui deleniti eum eos est. Quia nulla dolore repellat architecto quis.

Socials

instagram:

- url : https://instagram.com/hermannn

- username : hermannn

- bio : Autem ullam ut minima ratione laborum. Ut laboriosam eius optio.

- followers : 4854

- following : 2217

linkedin:

- url : https://linkedin.com/in/hermannn

- username : hermannn

- bio : Iste corrupti quia officiis maxime.

- followers : 455

- following : 927

tiktok:

- url : https://tiktok.com/@norberto.hermann

- username : norberto.hermann

- bio : Est voluptatem cum ut repellat.

- followers : 6606

- following : 466