State Farm Bodily Injury Limits: What You Need To Know

Let's talk about something that affects you more than you might realize—State Farm bodily injury limits. Yep, it's not exactly the sexiest topic in the world, but trust me, this is super important if you're looking out for yourself and your loved ones on the road. Imagine being involved in an accident where someone gets hurt. How are you going to cover those costs? That's where understanding your insurance policy and bodily injury limits come into play. So, buckle up because we're diving deep into this crucial aspect of auto insurance.

Now, before you think this is just another boring article about insurance, let me tell you something. This isn't just about numbers and policies; it's about protecting yourself from financial ruin. If you're involved in a serious accident and the injured party sues you, your bodily injury coverage could be the difference between staying solvent and going broke. And hey, nobody wants to deal with that kind of stress, right?

We'll break down everything you need to know about State Farm bodily injury limits, from the basics to advanced strategies. Whether you're a first-time driver or a seasoned pro, this guide is packed with info that can help you make informed decisions about your insurance coverage. So, let's get started!

- Filmsuche Erfolglos Filmdetails Alternativen

- Top Kannada Filme 20242025 Movierulz Streaming Ein Berblick

Understanding State Farm Bodily Injury Limits

First things first, what exactly are bodily injury limits? Think of them as a safety net for when accidents happen, and someone ends up injured. Your bodily injury coverage under State Farm kicks in to pay for medical expenses, lost wages, pain and suffering, and other damages related to injuries caused by an accident you're responsible for. But here's the kicker—it only covers up to the limit you've chosen. Once that limit is reached, guess who's on the hook for the rest? You got it—YOU!

Why Are Bodily Injury Limits Important?

Let me paint you a picture. Say you're cruising down the highway, minding your own business, when suddenly another driver rear-ends you. The other driver sustains serious injuries and racks up $200,000 in medical bills. If your bodily injury limit is only $50,000 per person, you're potentially facing a lawsuit for the remaining $150,000. Oof, that's a lot of cash to come up with.

Having adequate bodily injury limits is like wearing a helmet when riding a bike—it's there to protect you in case things go south. And let's face it, accidents happen. No matter how careful you are, there's always a chance of something going wrong. That's why it's crucial to understand your limits and make sure they're sufficient to cover potential damages.

State Farm's Standard Bodily Injury Limits

State Farm offers a range of bodily injury limits to suit different needs and budgets. Typically, these limits are expressed in two numbers, such as $25,000/$50,000 or $100,000/$300,000. The first number represents the maximum amount payable per person injured in an accident, while the second number is the total limit per accident for all injured parties combined.

Common Bodily Injury Limits Offered by State Farm

- $25,000/$50,000

- $50,000/$100,000

- $100,000/$300,000

- $250,000/$500,000

- $500,000/$1,000,000

As you can see, there's quite a range to choose from. But here's the thing—the higher the limits, the better protected you are. Sure, higher limits usually mean higher premiums, but the peace of mind they provide is priceless. And let's be honest, nobody wants to be caught short when it matters most.

Factors Affecting Your Bodily Injury Limits

Choosing the right bodily injury limits isn't a one-size-fits-all situation. Several factors come into play when determining what's best for you. Let's take a look at some of the key considerations:

Your Financial Situation

If you've got a lot of assets or a high income, you might want to consider higher limits. Why? Because if someone sues you and wins a judgment exceeding your coverage, your assets could be at risk. On the flip side, if you're just starting out and don't have much in the way of savings or property, lower limits might suffice. But remember, it's always better to err on the side of caution.

Driving Record and Habits

Your driving history plays a big role in determining your risk level. If you've got a clean record, you might feel more confident with lower limits. However, if you've had accidents or traffic violations in the past, it might be wise to bump up your coverage. Additionally, if you drive a lot or in areas with high accident rates, higher limits could provide added protection.

State Requirements

Each state has its own minimum requirements for bodily injury coverage. While these minimums are a good starting point, they're often not enough to fully protect you in the event of a serious accident. It's important to familiarize yourself with your state's regulations and consider going above and beyond if necessary.

How Much Bodily Injury Coverage Do You Really Need?

Now that we've covered the basics, let's tackle the million-dollar question—how much bodily injury coverage is enough? The answer depends on your individual circumstances, but as a general rule of thumb, most experts recommend at least $100,000 per person and $300,000 per accident. This level of coverage provides a good balance between cost and protection.

Assessing Your Risk

To determine the right amount of coverage for you, consider the following:

- How much can you afford to pay out of pocket if you're sued?

- What are the potential damages in a worst-case scenario?

- Do you have other forms of liability insurance, such as an umbrella policy?

By answering these questions, you'll have a clearer picture of your risk profile and can make an informed decision about your bodily injury limits.

The Cost of Higher Bodily Injury Limits

One of the main concerns people have about increasing their bodily injury limits is the cost. While it's true that higher limits typically result in higher premiums, the increase might not be as significant as you think. In many cases, the added cost is minimal compared to the potential savings in the event of an accident.

Is It Worth the Extra Expense?

Let's crunch some numbers. Say you increase your bodily injury limits from $50,000/$100,000 to $100,000/$300,000. Depending on your policy and driving record, this could add anywhere from $50 to $150 to your annual premium. Now, compare that to the potential costs of a lawsuit exceeding your coverage. Suddenly, that extra expense doesn't seem so bad, does it?

Additional Coverage Options to Consider

While bodily injury limits are a critical component of your insurance policy, they're not the only form of protection available. Here are a few other coverage options worth considering:

Umbrella Insurance

Umbrella insurance provides an extra layer of liability protection beyond your standard policy limits. It's a great option for those with significant assets or a higher risk of being sued. Think of it as a backup plan that kicks in when your primary coverage runs out.

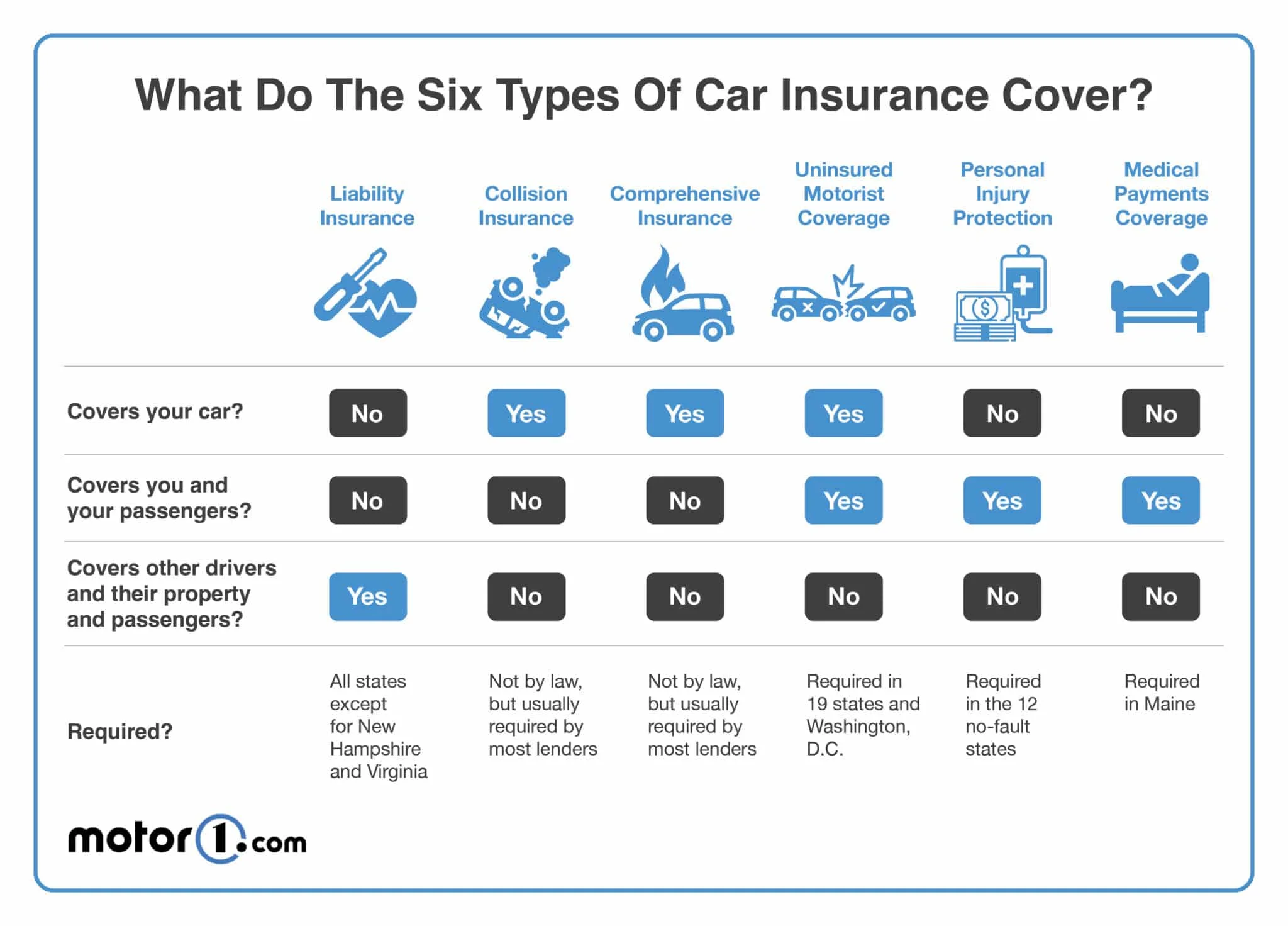

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you're involved in an accident with a driver who doesn't have insurance or doesn't have enough coverage to pay for your damages. It's a valuable safeguard in situations where the other party can't cover the costs of your injuries.

Real-Life Examples of Bodily Injury Limits in Action

To really drive home the importance of adequate bodily injury limits, let's look at a couple of real-life scenarios:

Scenario 1: The Minor Fender Bender

John is driving to work when he accidentally taps the car in front of him. The driver sustains minor injuries and racks up $10,000 in medical bills. Luckily, John has a bodily injury limit of $50,000 per person, so his insurance covers the entire cost. Crisis averted!

Scenario 2: The Major Accident

Susan is involved in a serious accident where multiple people are injured. The total damages exceed $500,000, but Susan only has a bodily injury limit of $100,000 per accident. She's now facing a lawsuit for the remaining $400,000, which could wipe out her savings and put her home at risk. Yikes!

How to Choose the Right State Farm Agent

When it comes to selecting the right State Farm agent, there are a few things to keep in mind. Look for someone who is knowledgeable, responsive, and willing to take the time to explain your options. A good agent will help you navigate the sometimes confusing world of insurance and ensure you have the coverage you need.

Questions to Ask Your State Farm Agent

- What are the most common claims in my area?

- How do my bodily injury limits compare to others in similar situations?

- Are there any discounts available for increasing my coverage?

By asking these questions, you'll gain valuable insights into your policy and make more informed decisions about your coverage.

Conclusion: Protect Yourself and Your Future

So, there you have it—the lowdown on State Farm bodily injury limits. Whether you're a new driver or a seasoned pro, understanding your coverage is essential for protecting yourself and your finances. By choosing the right limits and exploring additional coverage options, you can rest easy knowing you're prepared for whatever the road throws your way.

Now, it's your turn to take action. Review your current policy, talk to your State Farm agent, and make any necessary adjustments to ensure you have the coverage you need. And don't forget to share this article with friends and family who could benefit from the info. Together, we can all stay safe and protected on the road!

Table of Contents

- State Farm Bodily Injury Limits: What You Need to Know

- Understanding State Farm Bodily Injury Limits

- Why Are Bodily Injury Limits Important?

- State Farm's Standard Bodily Injury Limits

- Common Bodily Injury Limits Offered by State Farm

- Factors Affecting Your Bodily Injury Limits

- How Much Bodily Injury Coverage Do You Really Need?

- The Cost of Higher Bodily Injury Limits

- Additional Coverage Options to Consider

- Real-Life Examples of Bodily Injury Limits in Action

- How to Choose the Right State Farm Agent

- Conclusion: Protect Yourself and Your Future

Detail Author:

- Name : Prof. Wilson McDermott

- Username : rudy55

- Email : ada56@gmail.com

- Birthdate : 1990-05-04

- Address : 25458 Stephan Valleys Port Howard, OR 41261

- Phone : +1-618-653-5347

- Company : Schneider, Doyle and Adams

- Job : Agricultural Science Technician

- Bio : Est quisquam est quaerat dolorem. Sit officiis velit eveniet fugiat. Quibusdam ut sit aliquid aut beatae deleniti.

Socials

twitter:

- url : https://twitter.com/stillman

- username : stillman

- bio : Qui sunt rem et totam necessitatibus aut. Ut et vel eos porro optio nobis sed. Voluptatibus sit molestiae soluta expedita placeat voluptate necessitatibus.

- followers : 6311

- following : 668

instagram:

- url : https://instagram.com/stillman

- username : stillman

- bio : Temporibus ducimus quia possimus eos. Dolor eligendi veniam quia quia.

- followers : 4692

- following : 1097

linkedin:

- url : https://linkedin.com/in/sid967

- username : sid967

- bio : Quo iure reiciendis iusto.

- followers : 5289

- following : 413