State Farm Basic Car Insurance: Your Ultimate Guide To Affordable Coverage

Let’s talk about something that affects almost everyone who drives: car insurance. If you’re shopping around for coverage, chances are you’ve heard of State Farm. But what exactly does State Farm basic car insurance offer? Well, buckle up because we’re diving deep into this topic and breaking it all down for you. Whether you’re a first-time driver or someone looking to switch policies, this guide is here to help you make an informed decision.

Driving without insurance is not only risky but also illegal in most places. That’s where State Farm steps in. With decades of experience, they’ve become one of the leading names in the insurance game. But what makes their basic car insurance worth considering? Stick around as we explore everything from coverage options to pricing strategies.

Before we dive into the nitty-gritty details, let’s set the stage. Car insurance isn’t just a box to check off; it’s a safety net that protects you financially if something goes wrong. Whether it’s a fender bender or a major accident, having the right coverage can save you from unexpected expenses. And that’s exactly why State Farm basic car insurance has become so popular among drivers nationwide.

- Filmyfly Co Bollywood Vs Hollywood Wer Gewinnt Entdecke Mehr

- Marathifilme Infos Stars Mehr Filme Auswahl

What Is State Farm Basic Car Insurance?

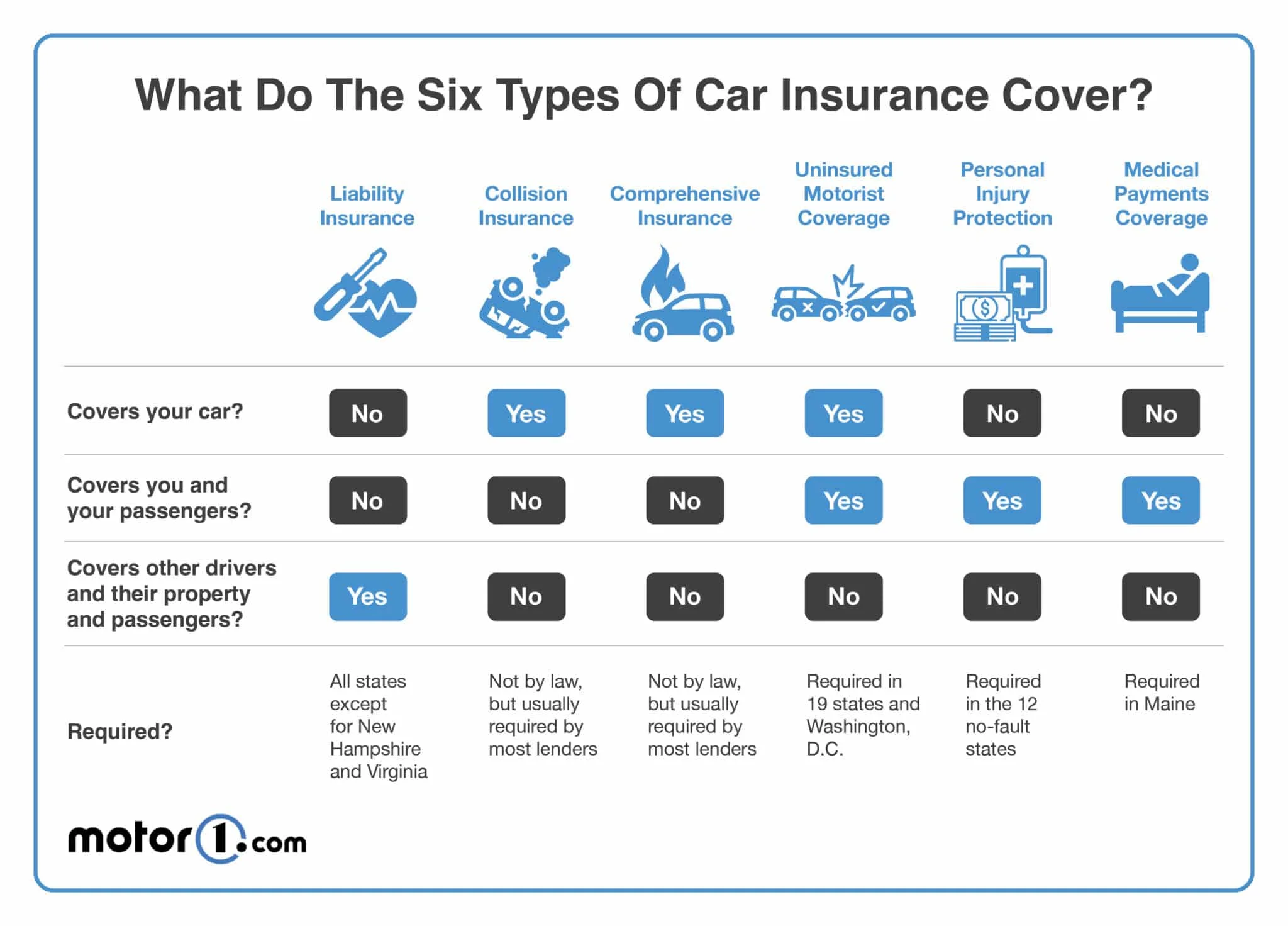

State Farm basic car insurance is designed to provide essential coverage for drivers at an affordable rate. It’s the bare minimum coverage required by law in most states, which includes liability protection for bodily injury and property damage. But don’t let the word "basic" fool you—this policy still packs a punch when it comes to protecting you on the road.

Here’s a quick breakdown of what you can expect:

- Liability Coverage: Protects you if you’re found at fault in an accident.

- Medical Payments: Covers medical expenses for you and your passengers.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you’re hit by someone without insurance.

Now, here’s the kicker: while State Farm basic car insurance gives you the essentials, it’s important to consider your unique driving needs. For example, if you live in an area with high theft rates, adding comprehensive coverage might be a smart move.

- Vegane Filme Entdecke Filme Mit Starker Botschaft Vegmovies

- Filmy4wap Dein Portal Fr Bollywood Hollywood Mehr 20242025

Why Choose State Farm Over Other Providers?

When it comes to choosing an insurance provider, trust and reliability are key. State Farm has been around since 1922, and during that time, they’ve built a reputation for being dependable. But what sets them apart from the competition?

For starters, State Farm offers personalized service. Their agents are local, meaning they understand the specific risks and regulations in your area. Plus, they have a massive network of claims adjusters ready to assist you whenever trouble strikes.

Customer Service Excellence

Customer service is a big deal when it comes to insurance. Let’s face it—when you’re dealing with a claim, the last thing you want is poor communication or long wait times. State Farm prides itself on offering 24/7 support through their mobile app, website, and phone lines.

Here’s a fun fact: State Farm handles more than 10 million claims each year. That’s a lot of satisfied customers who trust them to resolve issues quickly and fairly.

Breaking Down the Costs

Now, let’s talk about the elephant in the room: cost. How much does State Farm basic car insurance actually cost? The answer, like most things in life, depends on several factors:

- Your driving record

- The type of vehicle you drive

- Your location

- Your age and gender

- Whether you’ve bundled other policies with State Farm

On average, State Farm offers some of the most competitive rates in the industry. In fact, according to a recent study, their basic car insurance policies are often priced lower than competitors like GEICO and Allstate.

How to Save Money on Your Policy

Who doesn’t love saving money? Here are a few tips to help you reduce the cost of your State Farm basic car insurance:

- Bundle Policies: Combine your auto insurance with home or renters insurance for discounts.

- Take a Defensive Driving Course: Many states offer discounts for completing approved courses.

- Drive Safely: A clean driving record can lead to significant savings over time.

Remember, every little bit helps. Even a small discount can add up over the years, leaving more cash in your pocket for the things that matter.

Understanding Your Coverage Options

State Farm basic car insurance is just the starting point. Depending on your needs, you might want to explore additional coverage options. Here’s a quick rundown:

Comprehensive Coverage

This protects your vehicle against non-collision incidents like theft, vandalism, or natural disasters. If you drive a newer car or live in an area prone to bad weather, this could be a wise investment.

Collision Coverage

As the name suggests, collision coverage kicks in if you’re involved in an accident with another vehicle or object. It’s especially useful for drivers with newer cars who want to avoid hefty repair bills.

When deciding which coverage options to add, think about your specific situation. For instance, if you have an older car, comprehensive and collision coverage might not be worth the extra cost. But if you’re leasing or financing a vehicle, these add-ons are usually mandatory.

State Farm Basic Car Insurance for First-Time Drivers

First-time drivers often face higher premiums due to inexperience. But fear not! State Farm offers several programs designed to help young drivers save money while staying safe on the road.

Good Student Discount

Maintaining a high GPA can pay off literally. State Farm offers discounts to students who achieve good grades, proving that hitting the books can also hit the wallet in a good way.

Teen Safe Driver Program

This innovative program uses technology to monitor safe driving habits. By encouraging teens to avoid risky behaviors like speeding or hard braking, parents can earn discounts on their policies.

These programs not only help lower costs but also promote responsible driving habits, which is a win-win for everyone involved.

State Farm Basic Car Insurance for Seniors

Seniors often get a bad rap for being unsafe drivers, but statistics tell a different story. In fact, many older drivers have years of experience and fewer accidents than their younger counterparts. State Farm recognizes this and offers special discounts for seniors who meet certain criteria.

Safe Driver Discount

Drivers over 55 who complete approved defensive driving courses can qualify for discounts. It’s a great way to refresh your skills and save money at the same time.

Low Mileage Discount

If you don’t drive much, why pay for coverage you don’t need? State Farm offers reduced rates for seniors who log fewer miles annually, making it easier to stick to a budget.

These senior-specific options show that State Farm understands the unique needs of different demographics, ensuring everyone gets the coverage they deserve.

State Farm Basic Car Insurance and Claims Process

Let’s be honest—no one looks forward to filing a claim. But when accidents happen, having a smooth claims process can make all the difference. State Farm has streamlined their system to ensure customers receive prompt and fair resolutions.

Here’s how it works:

- Contact State Farm immediately after the incident.

- Provide details about the accident, including photos and witness statements if possible.

- A claims adjuster will assess the damage and determine the appropriate compensation.

State Farm’s mobile app makes reporting claims a breeze, allowing you to submit photos and documents directly from your phone. Plus, their dedicated team is available around the clock to answer questions and guide you through the process.

Is State Farm Basic Car Insurance Right for You?

At the end of the day, choosing the right insurance policy depends on your individual circumstances. State Farm basic car insurance is a solid option for drivers who want reliable coverage at a reasonable price. However, it’s always a good idea to shop around and compare quotes before making a final decision.

Key Factors to Consider

Before signing up, ask yourself these questions:

- Do I need additional coverage beyond the basics?

- Am I eligible for any discounts or special programs?

- How does State Farm’s customer service compare to other providers?

By weighing these factors, you’ll be better equipped to choose a policy that meets your needs and budget.

Conclusion: Take Action Today

We’ve covered a lot of ground in this guide, from understanding State Farm basic car insurance to exploring its benefits and drawbacks. Whether you’re a first-time driver or a seasoned pro, having the right coverage is crucial for peace of mind on the road.

So, what’s the next step? Head over to State Farm’s website or visit a local agent to get a personalized quote. And don’t forget to check out our other articles for more tips on saving money and staying safe behind the wheel.

Got questions or feedback? Drop us a comment below—we’d love to hear from you. Together, let’s keep the roads safe and your wallets happy!

Table of Contents

- What Is State Farm Basic Car Insurance?

- Why Choose State Farm Over Other Providers?

- Breaking Down the Costs

- Understanding Your Coverage Options

- State Farm Basic Car Insurance for First-Time Drivers

- State Farm Basic Car Insurance for Seniors

- State Farm Basic Car Insurance and Claims Process

- Is State Farm Basic Car Insurance Right for You?

- Conclusion: Take Action Today

![State Farm Rental Car Insurance Is It Worth Buying? [2023]](https://www.mountshine.com/wp-content/uploads/2023/02/State-Farm-Rental-Car-Insurance.jpg)

Detail Author:

- Name : Bryana Barrows Sr.

- Username : unique63

- Email : kiera.johnston@hotmail.com

- Birthdate : 1987-12-08

- Address : 3958 Keara Centers Apt. 424 East Woodrow, KS 27430-5783

- Phone : (530) 612-1037

- Company : Conn, Lemke and Koepp

- Job : Tree Trimmer

- Bio : Recusandae perferendis fuga rerum et. Quos maxime ea sed aut ut voluptatem. Culpa minima suscipit quae ducimus libero perspiciatis id.

Socials

tiktok:

- url : https://tiktok.com/@meaghan.mosciski

- username : meaghan.mosciski

- bio : Facere animi et eum debitis porro doloremque ut.

- followers : 482

- following : 890

instagram:

- url : https://instagram.com/meaghan_dev

- username : meaghan_dev

- bio : Sed rerum totam dolores eligendi nemo nihil similique quas. Fugiat sint vel sed.

- followers : 448

- following : 1027